Nvidia grows 94% and Wall Street relaxes.

Posted on: 20 November 2025

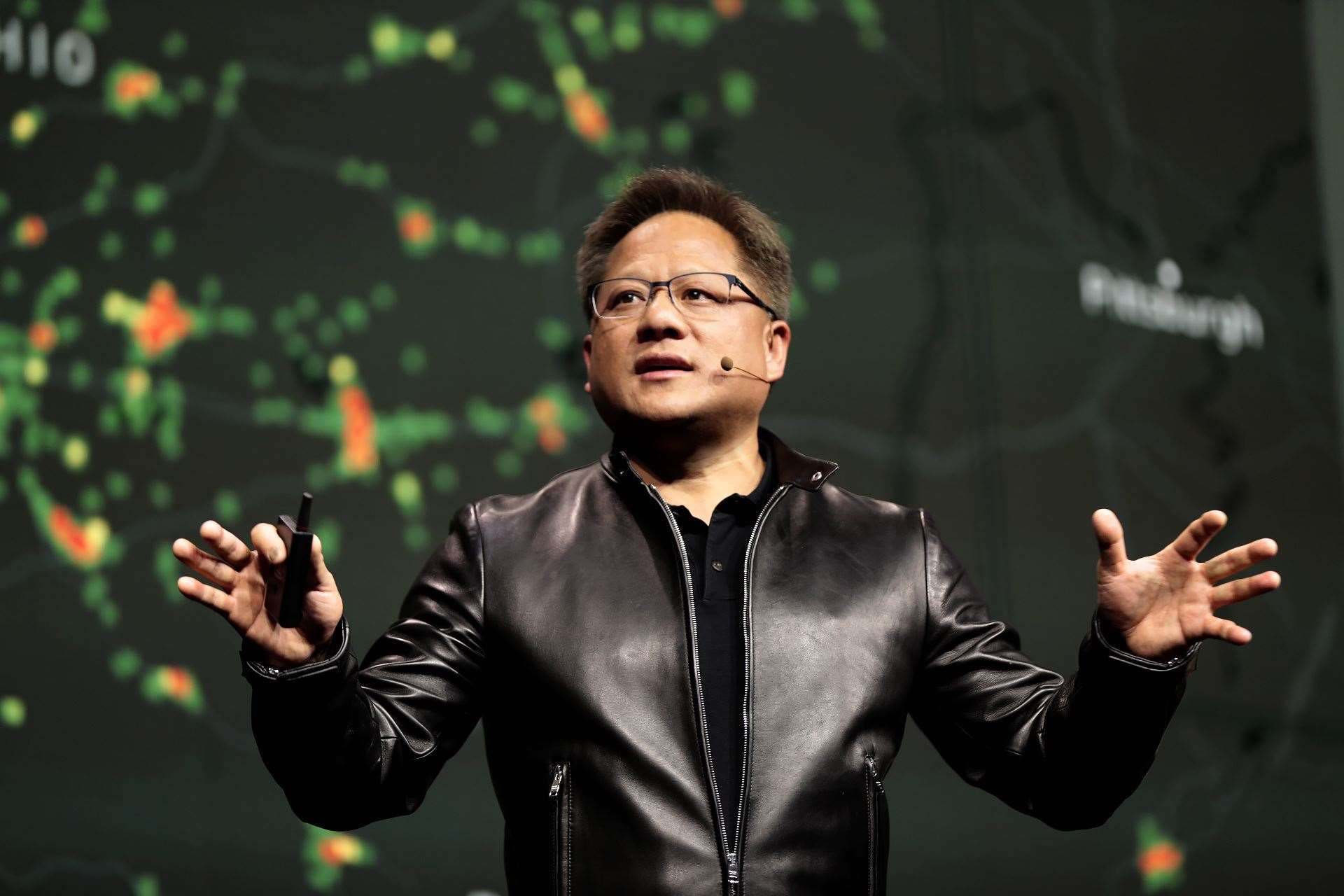

Nvidia published its third-quarter results on 20 November 2024. Revenue: $35.1 billion (+94% year-on-year), above analyst expectations. Guidance for the fourth quarter: $37.5 billion, still above estimates. The initial market reaction? Nervous oscillations between -2% and +2%, not the explosive rally many were expecting.

But the prevailing narrative remained unchanged: "See? The results confirm that demand is solid. This isn't a speculative bubble."

Let me show you why this logic is structurally flawed, and why the mechanism currently operating can generate profoundly disappointing results even without being "pure speculation" in the classic sense of the term.

The historical pattern nobody wants to see

I've managed disruptive technology transitions first-hand. I saw this identical mechanism during the dot-com bubble of 2000. Amazon, Cisco, Oracle regularly beat quarterly expectations. Every quarter the narrative was "demand is solid, the fundamentals hold, this time is different because the Internet is real and will change everything".

Then the castle collapsed anyway. Not because companies were lying about the numbers, the revenues were real and verifiable. But because they were based on a collective spending cycle that had momentum but no long-term economic sustainability.

Internet technology was genuine and transformative, today it's bigger than anyone imagined in 2000. But this didn't prevent brutal repricing when it became clear that the timing between infrastructure investment and monetisation was completely out of phase.

The cascade of misaligned incentives

What's operating today isn't an orchestrated conspiracy, it's a classic failure of incentive alignment that produces structurally problematic collective behaviour.

Look at the system as a whole.

Cloud service providers (Microsoft, Amazon, Meta, Google) are each spending between $75 and $100 billion on artificial intelligence infrastructure investments. Not because they have a clear return on investment today, but because nobody can afford to be the only one NOT investing if artificial intelligence becomes dominant. It's a classic prisoner's dilemma: the rational choice for each individual player is to invest, but collectively they're probably building too much capacity too quickly.

Nvidia sells processors to these players and shows explosive growth. Wall Street sees the numbers and says "demand is real!" Cloud providers see competitors spending and feel forced to increase their own investments. The cycle self-reinforces in an apparently virtuous spiral.

Institutional investors see this growth and must participate because their mandate is "don't underperform peers", not "protect capital long-term". If all competing funds are invested in artificial intelligence and they're not, they risk being fired BEFORE any eventual bubble bursts.

The media amplifies the "get rich with artificial intelligence" narrative because it generates engagement. "Artificial intelligence has timing issues" doesn't attract readers.

Retail investors see all this movement and think "the professionals know something I don't, I must get in immediately".

The result is that nobody is actually evaluating economic fundamentals, everyone is evaluating others' behaviour. This is what economists call an "information cascade": each level makes decisions based on "what others know" rather than direct analysis of underlying economic data.

The lethal timing mismatch

But here's where the real structural problem that few are rigorously analysing lies.

How many of these cloud providers are generating incremental revenue from artificial intelligence that justifies their massive investments? A minuscule fraction of total investment. Microsoft spends $20 billion in one quarter on artificial intelligence infrastructure. Is it generating incremental revenue that justifies this spending? Not yet, or at least not to the necessary extent.

They're not earning zero, that's clear. But they're spending on "strategic optionality", on artificial intelligence capability even without knowing exactly how to monetise it effectively. This is defensive spending forced by game theory, not offensive growth spending based on a clear and verifiable economic plan.

And here lies the temporal gap that history teaches is lethal for those who invest at peak prices.

2024-2025: Massive infrastructure deployment (cost: hundreds of billions overall) 2026-2028: Usage grows but is still below installed capacity, return on investment is negative for many players 2030-2035: Monetisation finally arrives at scale, but many original builders are no longer economically alive to see it

Anyone investing today at current prices is implicitly assuming that monetisation will arrive in 2 to 3 years at most. But every historical analogy with transformative technologies suggests a 7-10 year lag between massive infrastructure deployment and widespread profitable monetisation.

The perfect analogy: fibre optics 1998-2001

The most accurate parallel with what's happening today is what occurred with fibre optic infrastructure during the dot-com bubble era.

Every chief executive of telecommunications companies said "we must invest in broadband for the future". Everyone was right about strategic direction, broadband was and is essential for digital development. But collectively they built ten times the capacity that the market could economically absorb in a decade.

The technology won long-term. The Internet today uses all that fibre optic and requires even more. But the majority of companies that built the original infrastructure either failed or were acquired at fire-sale prices.

Think of Cable & Wireless in the UK: once a telecommunications giant, massive investments in fibre infrastructure in the 1990s and early 2000s, then progressively dismantled and sold off in pieces. The infrastructure that Cable & Wireless built is still there, works perfectly and is essential. But those who financed those initial investments saw their capital change hands repeatedly, often with significant losses. The final winners bought the assets at a fraction of the original construction cost.

It wasn't pure speculation in the sense of investing in something completely imaginary. It was simply too much investment too quickly relative to the market's actual adoption rate. The temporal gap massacred those who were right about the technology but wrong about monetisation timing.

Why "beating expectations" proves nothing

This brings us back to Nvidia and why beating quarterly estimates isn't as reassuring as the mainstream narrative would have you believe.

During every major bubble, companies at the centre of the phenomenon regularly beat expectations, until suddenly they don't anymore. Not because demand disappears instantly overnight, but because when even a single major buyer says "let's pause investments for a couple of quarters", the cascade effect is brutal given market concentration.

Nvidia depends on 5-10 mega-buyers for the majority of its total revenue. These buyers are all making defensive spending forced by game theory, as we've seen. What happens when one of them, due to cost pressures, strategy change, or simply realisation that actual utilisation of deployed processors is below original expectations, decides to slow purchases?

The system is fragile with respect to investment synchronisation, not with respect to underlying technology quality. And this is a crucial distinction that too few are making.

Now let's go behind the scenes

I'm not saying "sell everything tomorrow" or "artificial intelligence is an overrated technology". I'm saying that the mechanism operating today produces structural vulnerability even when the underlying technology is genuine and transformative.

Some uncomfortable truths that emerge from the analysis:

First. Winning technology doesn't automatically equal correct timing for investment. You can be perfectly right about the long term and still lose a significant amount of capital if your entry point catches the timing mismatch.

Second. Quarterly results above expectations during the massive deployment phase tell us nothing reliable about the monetisation phase. Pickaxes sell extremely well during a gold rush, this doesn't remotely guarantee that gold prospectors will find enough gold to repay their investment.

Third. The fact that professional investors continue to invest massively doesn't prove that valuations are justified by fundamentals. It only proves that incentive structures force them to participate even when they see evident warning signals.

Fourth. You don't need "pure speculation" in the classic sense to generate devastating results for investors. You only need too many players investing too quickly based on future expectations that mutually reinforce each other until, inevitably, they don't anymore.

Will artificial intelligence profoundly transform every sector? Probably yes, perhaps even more radically than optimists think today. But the relevant question for anyone considering investing today isn't "will artificial intelligence have an enormous impact?", it's rather "have current valuations already incorporated very optimistic scenarios that require rapid monetisation, or are they conservative relative to realistic timelines based on historical precedents?"

The honest answer, looking at data and historical analogies, is that we're much closer to the first scenario than the second.

And the difference between these timelines, three years versus ten years for full and widespread monetisation, is exactly where wealth is systematically created or equally systematically destroyed.

A lesson from recent history

When someone tells you with certainty "look, they've beaten expectations again, demand is absolutely real", remember that Amazon regularly beat expectations in 1999, and then the stock fell from $100 to $5 over two years.

The technology won spectacularly long-term. But the timing of massive infrastructure deployment relative to actual monetisation financially massacred those who bought at valuation peaks.

History never repeats identically, that would be too simple. But it rhymes in recognisable ways for those who've studied these mechanisms. And this rhyme we're hearing today sounds dangerously familiar to those who've seen similar films before.

The problem is never technology quality. It's always the timing between construction and profitable utilisation, and the distance between current valuations and realistically obtainable future cash flows.

On this, history tends to be a merciless but reliable teacher.